CEO pay levels have decreased in many of Australia’s listed companies, but bonus payments have become the norm, new research from the Australia Council of Superannuation Investors (ACSI) shows. The study reveals that over the past year, a CEO is more likely to lose their job than their bonus.

CEO Pay in ASX200 Companies is ACSI’s longest running research report and this, the 23rd edition, examines remuneration outcomes for 2023. This year’s study again includes unique ‘realised pay’ data which cuts through complex public reporting to provide a clearer picture of the pay received by Australian CEOs.

Realised pay for ASX100 CEOs fell marginally in FY23 with the median dropping from $3.93m to $3.87m – the lowest median in the 10 years the ACSI study has collected realised pay data. The fact that CEO pay has remained static indicates that greater investor scrutiny and focus from boards is having an effect.

However, it’s a different story with executive bonuses. In the ASX100, only two CEOs didn’t take home a bonus in FY23. In the ASX100, CEOs received a median bonus of 66.3% of their maximum potential. There were 24 termination payments across the full ASX200 sample, meaning that, once again, a CEO has more chance of being terminated than missing out on a bonus.

“Bonuses should not become a given in Australian companies. At a time when companies are focused on productivity and performance, it is critical that bonuses are only paid for exceptional outcomes.” said Ed John, Executive Manager, Stewardship at ACSI.

“While overall pay levels have dropped, investors and boards must not become complacent. The numbers show that we could see a breakout in CEO pay levels in future. It will be critical that boards pay close attention and ensure performance hurdles are set at the right levels,” Mr John said.

Key findings:

- Total realised pay has fallen. ASX100 median CEO pay fell from $3.93m to $3.87m – the lowest median in the 10 years the ACSI study has collected realised pay data. The ASX101-200 median also fell from $2.10m to $1.95m.

- CEOs are receiving consistently high bonus awards. The median ASX100 CEO in FY23 received a bonus at 66.3% of maximum (FY22: 71%) while for the ASX101-200 the median bonus outcome was 60.7% of maximum (FY22: 68%).

- Over the nine years the ACSI study has collected CEO bonus outcomes, the median bonus has been at least 60% of maximum every year for ASX100 CEOs (other than the COVID-affected FY20).

- Only two ASX100 CEOs and six ASX101-200 CEOs received zero bonus for FY23 meaning that, once again, a CEO has more chance of being terminated than missing out on a bonus (there were 24 termination payments across the full ASX200 sample in FY23).

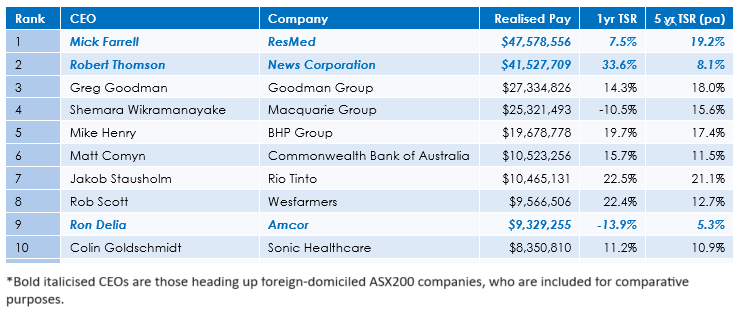

- High realised pay outcomes for CEOs in companies listed Australia but based in the US. Resmed’s Mick Farrell again eclipsed the local talent with $47.58m (FY22: $47.14m), followed by News Corp’s Robert Thomson on $41.53m.

- The highest termination payment in FY23 was $7.61m for former CSL CEO Paul Perreault.

The research also highlights some clear warning signs for Australian boards and investors in the years ahead. Reported pay levels for ASX 200 CEOs edged up in the year, which is normally a precursor for much higher realised pay outcomes in the future. The median reported pay for ASX100 leaders topped $5m for the first time. The previous record was $4.73m in FY17.

Greg Goodman of Goodman Group remains highest-paid domestic CEO with realised pay of $27.34m. Macquarie’s Shemara Wikramanayake was again second, with realised pay of $25.32m.