Bonuses for listed company CEOs have retreated from last year’s record high, according to research released today by the Australian Council of Superannuation Investors (ACSI). The average realised pay for ASX100 CEOs has also fallen to the lowest level recorded in the past nine years but still represents 55 times average adult earnings.

CEO Pay in ASX200 Companies is ACSI’s longest running research report and this, the 22nd iteration, examines remuneration outcomes for 2022. For the ninth year, it also outlines ‘realised pay’ – the value of cash and equity actually received by CEOs, as opposed to the statutory accounting valuations included in annual reports.

“It is good to see more restraint on executive pay in Australian companies over the past year but there is still an ‘everyone wins a prize’ attitude in some parts of the market. Investors look for any bonuses paid to executives to be linked to the delivery of value to shareholders over the long-term.” Ed John, ACSI’s Executive Manager, Stewardship said.

“Investors will be watching closely as reporting season gets under way and we see the numbers for 2023. It has been a choppy year for investors in many companies – boards will need to consider performance carefully when deciding on remuneration this year.

“If performance is down in 2023, we expect to see bonuses follow. We don’t want to see companies changing the goalposts when they have a bad year.”

The research also found that the 11 foreign domiciled company CEOs in the ASX200 took home, on average, more than $11 million in 2022. Local chief executives, by contrast, received an average of $4.17 million.

“The positive influence of Australian investors is illustrated by the fact boards have applied greater restraint compared to companies based in the US and other markets,” Mr John said.

Key findings

- Average realised pay for ASX100 CEOs fell to the lowest level recorded in the nine years that realised pay data has been collected. As a multiple of average adult earnings, average realised CEO pay in the ASX100 fell from the post pandemic high of 98x to 55x adult weekly earnings.

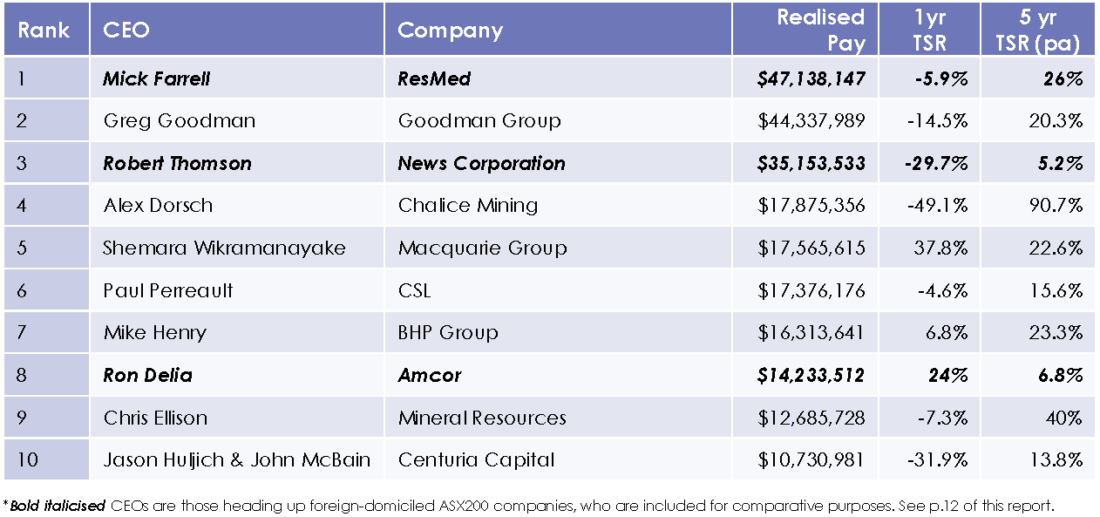

- Three of the top 10 realised-pay outcomes, were achieved by US-based executives, with Resmed’s Mick Farrell topping the table at $47.14mn (note – these foreign-domiciled company figures are not included in Australian averages).

- The average realised pay for a foreign company CEO was $11.11mn compared to $4.17mn for the 159 Australian company CEOs. This average was largely due to ResMed’s Farrell and News Corporation’s Robert Thomson ($35.15mn including a cash bonus of US$8.13mn).

- Goodman Group’s Greg Goodman had the highest realised pay outcome for a domestic CEO with $44.34mn, although well down on the $264.2mn peak set in FY21 by Afterpay’s co-CEOs Anthony Eisen and Nick Molnar.

- Macquarie Group’s Shemara Wikramanayake has become the first woman to top the reported earnings table for ASX200 CEOs in successive years, with $23.72mn in FY22 (FY21: $15.97mn). This indicates participation in the highest realised pay list in future years.

- The median bonus outcome for an ASX100 CEO fell from the FY21 record of 76.7% to 71% of potential maximum – reverting to the outcomes of around 70% of maximum observed from FY15-18.

- Qantas’ Alan Joyce was the only ASX100 CEO to receive zero bonus. Joyce also received zero in FY21 & FY20. Joyce was, however, awarded a lucrative two-year retention equity allocation in FY22 which, at current share prices, will be worth ~$4.45mn if it vests (at a share price of $6.40).

- Charter Hall’s David Harrison and Steadfast’s Robert Kelly are the only ASX200 CEOs in the survey to have received maximum potential bonuses for the last four financial years, receiving a total of $10.02mn and $7.68mn respectively.

- Median fixed pay for the ASX100 CEO sample in FY22 ($1,741,724) was at its lowest level in the past 10 years. FY22’s result was 9% lower than in FY11 – the highest median in the history of the ASX100 study was FY12 at $1.95mn. This result follows the trend of new CEOs coming in at lower pay levels than their predecessors.

- The CEO with the highest fixed pay in the ASX200 sample in FY22 was an ASX101-200 CEO, Philippe Wolgen of Clinuvel Pharmaceuticals. He was the only CEO whose fixed pay was above $3mn, due largely to him being paid accrued leave of $1.31mn.

10 highest-paid ASX200 CEOs on a realised-pay basis in FY22 (includes ‘foreign company’ CEOs)